Manufactured Home financing made easy.

You found your dream home. Let’s get a mortgage that’s perfect for you.

Manufactured home lending you can trust since 1985!

Since 1985, our mission has been to help people secure financing for their dream homes. Our financing programs are designed to help you thrive with minimal fees, low interest rates and favorable terms. Let our experience and knowledge work for you.

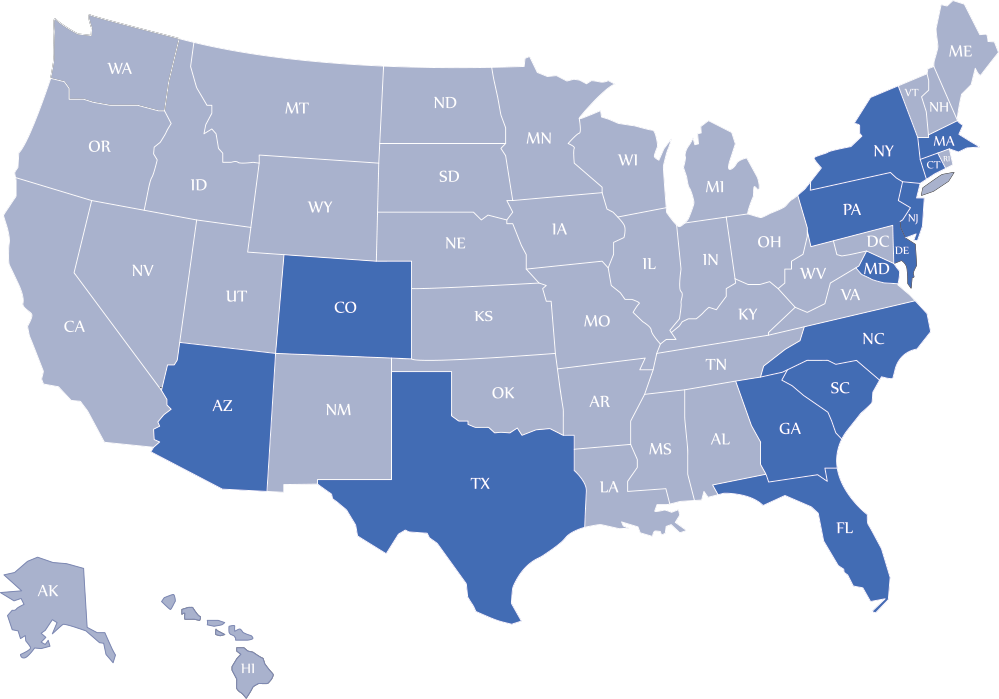

Coverage in 14 states and growing!

Our process is simple and easy.

1. Apply

The first step is on your financing journey is to apply. Our application process is simple and designed to be completed within 10 minutes. Click the “Start My Approval” Button to get started!

2. Get Approved

No one likes waiting! Our underwriters are manufactured home loan experts. They will review your financing application within one business day

3. Close

Work closely with your underwriter to provide the documents needed to complete your loan conditions. Once your conditions have been met, we will be ready to close at a location convenient for you.

Exceeding customer expectations since 1985.

Michael R.

Everything went really smooth and they were able to answer all my questions. The process was very simple and straightforward.

Lorene A.

My experience was very good with First Credit and the individual Rich that I was in touch with.

Charlene C.

Your company did a great job when I needed funds for my new modular home. Everyone was very helpful and very friendly.